Panoramica: perché i prezzi delle lavatrici sono più volatili

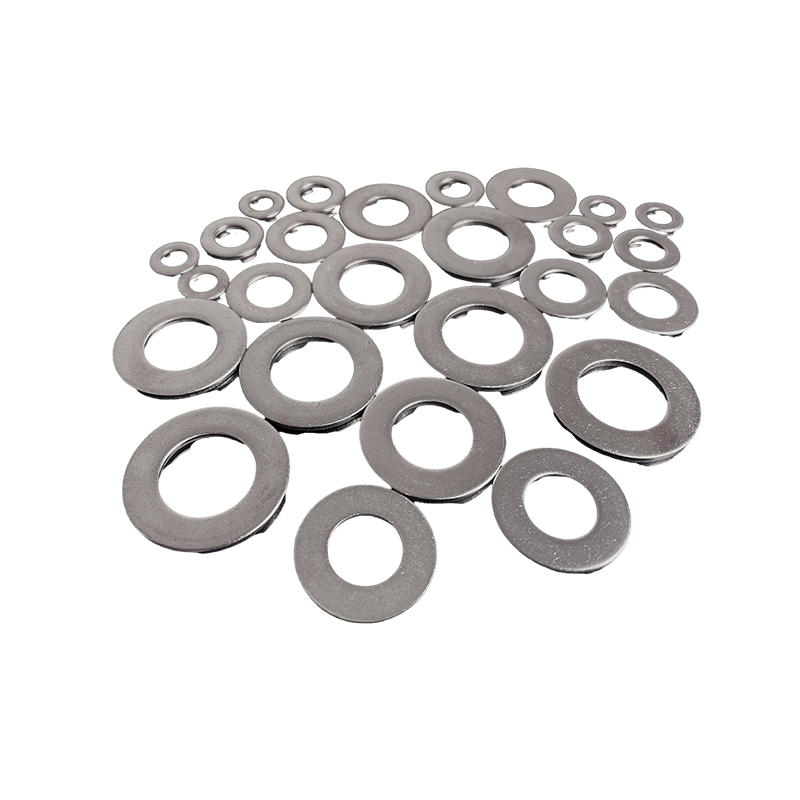

Rondelle in acciaio inox are a low-margin, high-volume commodity whose price is determined not just by sheet or coil prices but by an interplay of feedstock costs, regional mill margins, freight and lead-time risk, and demand from construction, automotive and industrial OEMs. Recent years have shown that even modest moves in nickel, ferrochrome or scrap can transmit rapidly into washer quotes because thin-gauge processing and precision stamping add discrete unit costs that suppliers pass on quickly. This article breaks the main drivers into practical categories and ends with sourcing and inventory tactics for purchasers and suppliers. :contentReference[oaicite:0]{index=0}

Fondamenti delle materie prime: nichel, cromo e rottami

The most direct input to austenitic stainless (e.g., 304/316) is nickel and chromium content. Nickel price swings influence 300-series mills' raw-cost; ferrochrome affects 200/400-series grades and alloy premiums. When nickel or ferrochrome spikes, mills raise coil prices and service centers widen spreads. Conversely, weak stainless demand in a regional market (for example a slowdown in construction) can lead to exporters discounting inventory — causing short-term price drops followed by tightness when inventories deplete. :contentReference[oaicite:1]{index=1}

Cosa dovrebbero guardare gli acquirenti

Track LME nickel and ferrochrome indices, stainless scrap prices, and regional mill premiums. For contract negotiations, index-link clauses tied to nickel or scrap are common; buyers without index protection risk abrupt increases. :contentReference[oaicite:2]{index=2}

Rischio logistico, di trasporto e di lead time

Freight volatility and port congestion amplify price moves for commoditized parts like washers. Higher container rates or reduced sailings increase landed cost per kilogram, while longer lead times raise working-capital and safety-stock expenses. The impact is greatest for smaller buyers who cannot aggregate shipments: the per-unit freight share is higher and sudden rate spikes are harder to absorb. Recent UNCTAD and market analyses show that container costs and geopolitical routing issues have kept freight costs structurally above pre-crisis levels, which continues to transmit into import-dependent fastener prices. :contentReference[oaicite:3]{index=3}

Leve operative per ridurre l’esposizione logistica

- Consolidare gli ordini di acquisto in carichi di container completi (FCL) quando possibile per ridurre il trasporto per unità.

- Utilizzare il doppio approvvigionamento tra stabilimenti nazionali e quelli regionali vicini per coprire i rischi relativi ai tempi di consegna.

- Negozia clausole di ripartizione delle merci nei contratti a lungo termine o acquista capacità di trasporto a termine durante i mesi a tariffa bassa.

Politica commerciale, tariffe e regionalizzazione

Trade measures and shifting sourcing strategies have become pronounced price drivers. Tariffs or antidumping duties push buyers toward local mills or alternate origins, where supply tightness may support higher prices even if global raw-material costs fall. In some markets, post-tariff reshoring has allowed domestic mills to secure higher blended margins, which feeds through into distributor and component prices. Buyers exposed to duty risk should explicitly model landed cost including potential tariff scenarios. :contentReference[oaicite:4]{index=4}

Cicli di domanda e dinamica delle scorte di lavatrici

Washers follow larger cyclical end-markets: construction, automotive, heavy equipment, electronics, and renewables. A surge in infrastructure spending or EV production raises demand for corrosion-resistant hardware; conversely, a slowdown in construction reduces stainless consumption. Because washers are produced in high volumes and small pack sizes, distributors often carry lower days-of-inventory relative to coils. That makes prices sensitive to sudden order uplifts or distributor stock-outs — situations where lead-time premiums appear quickly. Industry forecasts project steady growth in fasteners overall, but regional timing varies and creates transient tightness. :contentReference[oaicite:5]{index=5}

Tattiche di inventario

- Classificare gli SKU per criticità e tempi di consegna; mantenere scorte di sicurezza più elevate sui gradi speciali a lungo termine.

- Utilizza l'inventario gestito dal fornitore (VMI) per SKU ad alta velocità per attenuare le oscillazioni della fornitura.

- Implementare previsioni continue da 90 a 180 giorni legate alle fasce di prezzo contrattuali, ove possibile.

Una semplice tabella di ripartizione dei costi (esempio)

| Componente | Esempio % del costo unitario sbarcato |

| Materia prima (coil/lamiera) | 55% |

| Lavorazione e stampaggio | 20% |

| Imballaggio, test, QA | 5% |

| Merci e dazi | 10% |

| Margine del distributore e costo di inventario | 10% |

Strategie pratiche di approvvigionamento

Buyers and suppliers that survived recent cycles typically combine several actions: contract indexation to raw-materials, multi-sourcing with regional partners, flexible order batching, and active freight management. For engineered washers or plated/treated parts, move to make-to-order where possible to avoid inventory obsolescence. For commodity washers, lock in price bands for 3–6 months while allowing quarterly renegotiations tied to nickel/scrap. Suppliers should publish simple lead-time and surcharge schedules to reduce disputes. :contentReference[oaicite:6]{index=6}

Conclusione: aspettarsi volatilità periodica, gestirla con i dati

I cambiamenti nella catena di fornitura globale implicano che i prezzi delle rondelle in acciaio inossidabile continueranno a variare con gli indici delle materie prime, i costi logistici e i cambiamenti delle politiche regionali. La risposta più efficace è quella operativa: migliore segmentazione degli SKU, contratti condizionati che condividono in modo trasparente il rischio delle materie prime, strategia di trasporto e monitoraggio attivo dei mercati di nichel, ferrocromo e rottami.

English

English русский

русский Español

Español عربى

عربى

No. 2 Bridge, Chuangxin Road, Dainan Town, Xinghua City, Taizhou City, Jiangsu Province

No. 2 Bridge, Chuangxin Road, Dainan Town, Xinghua City, Taizhou City, Jiangsu Province  +86-17315333748(Wechat)

+86-17315333748(Wechat)

+86-17315333748(Wechat/Whatsapp)

+86-17315333748(Wechat/Whatsapp)